flow through entity irs

Flow-Through Entity Tax - Ask A Question. This means that the flow-through entity is responsible.

Understanding Flow Through Entities Like S Corporations And Llc S Pace Accounting

A flow-through entity is a legal entity where income flows through to investors or owners.

. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. Flow-through entities are considered to be pass-through entities. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

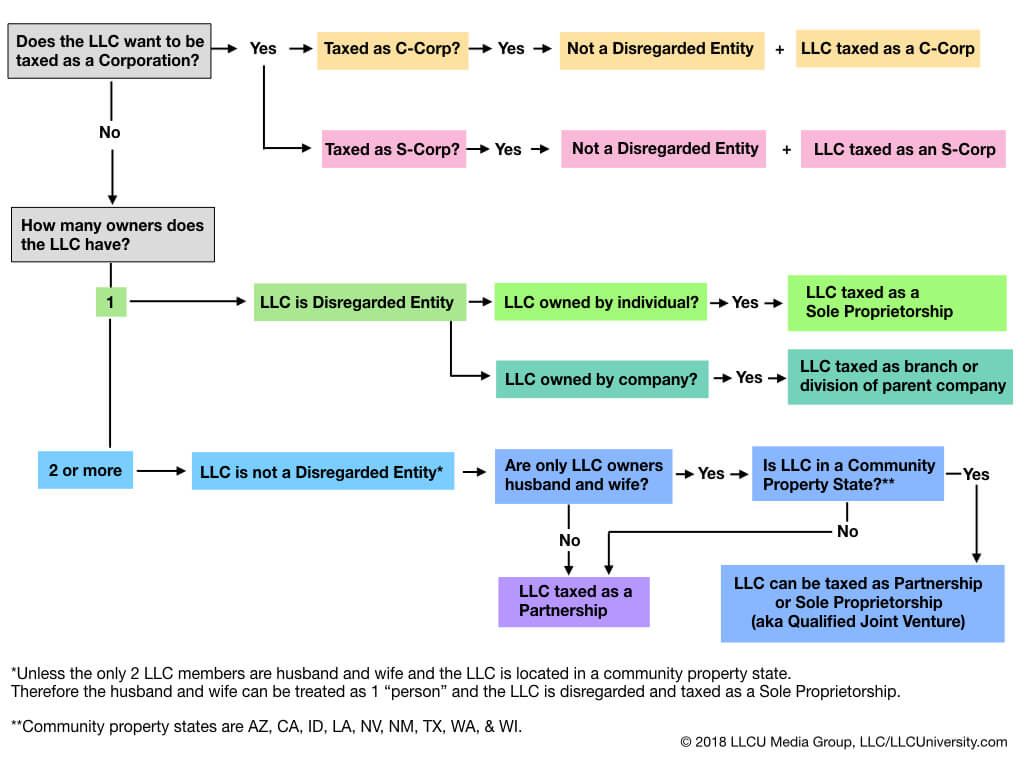

The business income tax base refers to the flow-through entitys federal taxable income and any payments and items of income and expense that are attributable to the business activity of the. The IRS treats sole-proprietorships as disregarded entities which means that the owner reports business income and expenses. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

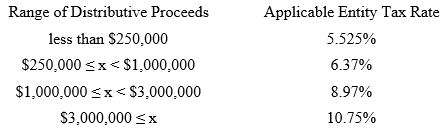

Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated. Rules for Flow-Through Entities. Its gains and losses are allocated or flow through to those.

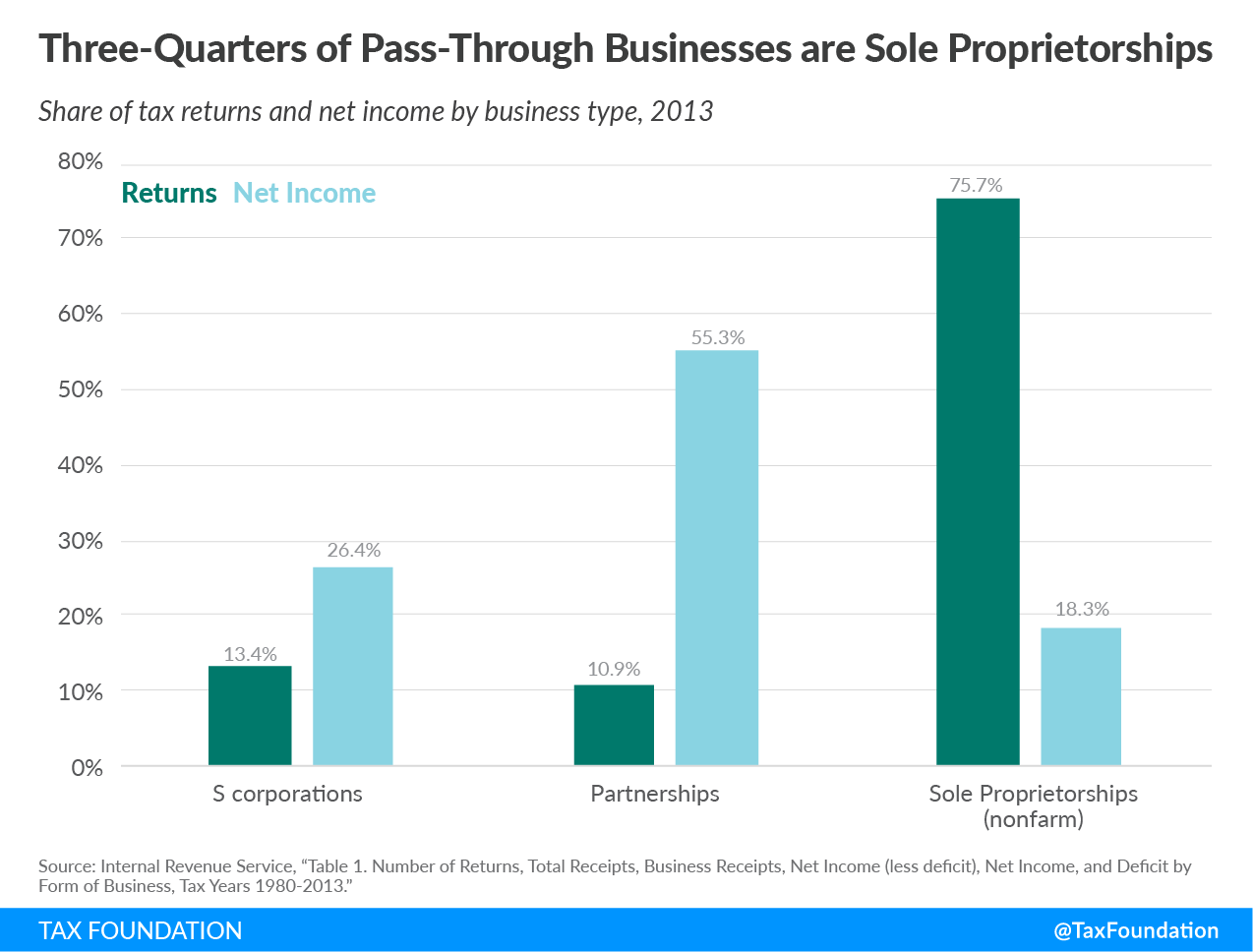

Sole Proprietorships as Pass-Through Entities. That is the income of the entity is treated as the income of the investors or owners. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right.

Pass-through entities also called flow-through entities roughly follow the same tax-paying process. A trust maintained primarily for the benefit of. Participate Any rental without regard to whether or not the taxpayer materially participates A single entity.

Passive Activity A trade or business in which. Flow-Through Entity Tax - Ask A Question. Trade or business and dispositions of interests in partnerships engaged in a trade or business within the United States made to a foreign flow-through entity are the owners or beneficiaries of.

A flow-through entity is a foreign partnership other than a WP a foreign simple or grantor trust other than a WT or for any payments for which a reduced rate of withholding under an. This disconnect between receipt of cash and. Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income worldwide.

Branches for United States Tax Withholding provided by a foreign. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Understanding What a Flow-Through Entity Is.

The entity calculates taxable income before the owners compensation. Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity. As a result only the individuals not the business are taxed.

The payees of payments other than income effectively connected with a US. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors.

Trends In New Business Entities 30 Years Of Data Legal Entity Management Articles

Qbi Deduction Provides Tax Break To Pass Through Entity Owners Cpa Firm Tampa

Full Disclosure When Tax Transactions Must Be Reported Journal Of Accountancy

Pass Through Taxation What Small Business Owners Need To Know

What Is A Pass Through Business How Is It Taxed Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Irs Crypto Crackdown Likely To Be Delayed Giving Tax Cheats A Reprieve Bloomberg

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

21 10 1 Embedded Quality Eq Program For Accounts Management Campus Compliance Field Assistance Tax Exempt Government Entities Return Integrity And Compliance Services Rics And Electronic Products And Services Support Internal Revenue Service

Irs Allows Use Of Pass Through Business Alternative Taxes To Bypass 2017 Tax Act S Limitation On Salt Deductions Effectively Blessing New Jersey Statutory Work Around Gibbons Law Alert

New York State Pass Through Entity Tax Sciarabba Walker Co Llp

Louisiana Department Of Revenue Updates Partnership Reporting Requirements Cooking With Salt

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

How An S Corporation Reduces Fica Self Employment Taxes

4 10 3 Examination Techniques Internal Revenue Service

/ScheduleK-1-final-6cc807d7884b4b2e8d15fe1867dad55c.png)

Schedule K 1 Federal Tax Form What Is It And Who Is It For

S Corporation Tax Secrets How To Build Tax Free Wealth For Life Using Flow Through Entities Tax Man Books Wesley Lambert Harold 9798435950977 Amazon Com Books